Apps That Let You Borrow Money Until Payday

Loan apps can be a great way to get some extra cash. There are many different loan apps available today. Some apps will lend you money with no credit card or background check needed. You don’t need to do anything except sign up and give your bank account information so they can process your payouts. Loan amounts range anywhere from $50-$100 for quick loans, all the way up to $3,000 if someone really needs it.

Read on to learn what things you will need to apply for a loan by apps. Let’s discuss further.

Payday Loans Apps:

Benefits of Payday Loan App

Same-Day Funding

These apps have a fast loan processing mechanism. A person can easily complete the loan application process in a few minutes. Additionally, you will receive the funds in your account in less than 24 hours.

Online Application

You will get immediate access to the loan after going through a straightforward and easy application process online.

Loan is Unsecure

The best part is that payday loans don’t scrutinize your physical assets. This is because you are taking a loan against your paycheck.

Rebuild your Credit

Some apps providers can help you rebuild or build your credit score by sending your loan payment information to credit reporting agencies. As this report contains information about your quick loan repayment ability, it can improve your score.

Increase in Loan Limits

Some apps offer you a feature that the more you borrow, and sooner you return the loan, the more chances you have to unlock the higher amount of loans.

How Money Lending Apps Work

Cash Advance apps are open to anyone with a mobile phone. You’ll need to sign up for an account before you can request a cash advance.

Signing up for an account means that you’ll need to provide some personal information, such as:

- Name

- Home address

- Phone number

- Social Security Number

- Employer’s name and address

If you want the money transferred into a different bank account, you’ll also need to provide those details.

Some apps require you to open up a banking account with them and to have your paycheck directly deposited into that account. Doing this saves you from having to undergo a credit check. By giving the lender access to your paycheck, you secure the loan. The app will take the money from your account on your next payday.

Money lending apps have different policies and requirements for cash advances. Be sure that you read the details in the agreement to understand what will be expected of you and what you’re being offered. Some of these cash advance providers have high fees, and others take several days for the money to transfer into your account. Both of these may significantly impact your finances, and you’ll want to be aware of them.

When to Use Cash Advance App

As with any payday advance, there are some reasons you’ll want to consider using an app to get some extra cash, such as:

- Emergency – If you have an emergency need, like a car repair or health crisis, being able to get some extra cash quickly can relieve some of the stress. Alternatively, not having the money to deal with these issues may cost you more in the long run. For example, lost work can turn your short-term cash crunch into a long-term financial ordeal.

- Avoid extra fees – If you’re facing hefty late fees on some bills that are due, using an app to get the money to pay these bills quickly can save you a lot of money.

- Prevent bounced check – If there is a chance that one of your checks may bounce, you could be facing some penalty fees from your bank and the recipient. Cash advance loans can prevent this from happening.

Cost of a Payday Advance App

The charges that you have to pay greatly vary depending on the payday app you have chosen to apply. Some payday advance app providers don’t charge any interest. They also want to provide customers maximum fund amounts in addition to the amount of their loan, which is a method to pay it forward. However, some apps like Earnin are extremely beneficial in terms of loans but don’t facilitate people as much as other apps do.

Some other payday lenders, such as Dave or Bright, charge a membership fee. They may also ask for additional fees for some other features and services, such as instant transfer of funds. Not to mention, membership fees, tips, and other charges are not disclosed in the forms of an APR with customary loan disclosures. This is only because of the gray areas and current loopholes of laws. For instance, according to the American Banker, the suggested tips on the Earnin application can equate to an APR rate of 730%. This is higher than the online payday loans and significantly higher than the loan providers like Possible, around 150-20% APR. This is one of the primary reasons why the New York government has concerns about the payday apps like Earnin.

On the other hand, payday loan apps ask for finance charges or interest rates when giving the quick funds that are around $15 to $20 on each $100 range. Getting loans from different payday lenders’ apps gives you similar or cheaper fee rates. They also provide you with multiple pay periods so that you can easily repay, giving maximum flexibility and a chance to build a good credit history.

Best Payday Loan Apps

1. Earnin

Earnin allows you to access your pay whenever you do the work. You need to give information about where you work and bank account details to Earnin. They will track your working hours so that you can cash the funds when you need them.

Additionally, when you get a paycheck, this app will deduct the money that you have already taken from your salary. However, they will not charge fees or interest.

How to Borrow Money from Earnin?

- Upload the Earnin app to your phone;

- Create the Earning account;

- Create all your information about payday (you need to describe where you work and how many hours you work, to prove work hours you need to upload a timesheet to your Earnin account);

- Fill in your checking bank account and connect with the app (you can borrow money if just your bank is on the list of banks that Earnin supports);

- You need to prove your employment (it means you must connect the app and your employer);

- If everything is ok, you need to wait for verification (it can take up to 2 days).

How Much You Can Get from Earnin?

If you are a new client you can get commonly $100, further amounts can go up to $500.

How Much does it Cost to Borrow Money with Earnin

Earnin does not have fees or any other charges. You can just leave tips for using the app and that’s all.

2. Dave

This app helps you plan your expense. Dave will identify bills, analyze your spending, and notify you when you have upcoming costs. In addition to it, you can get a 0% APR for a loan of more than $75.

Similar to Earnin, Dave puts the funds in your account and deducts it once you get the salary. This app also costs you $1 every month as a membership fee. But it also saves you from spending money on overdraft fees and interest rates.

How to Borrow Money from Dave?

- Upload the Earnin app to your phone;

- Create an account;

- Connect your bank account with the Dave app.

How Much You Can Get from Dave?

Up to $100 that clients can obtain with the Dave app. Also, you can qualify for a $200 cash advance, for that you need to activate Dave’s debit card and connect direct deposits to your account.

Dave Fees / Charges

No fees and interests, clients pay only $1/monthly for membership.

3. Brigit

This is another amazing app that keeps track of your budget as well as offers cash advances. To enjoy the benefits of this app, you will need an active account that is working for at least 60 days. Plus, this account should also have a positive balance and a record of at least three direct deposits from your company.

Based on your income, you can qualify for loans of more than $250. The best feature of Birgit is that this app will automatically transfer a short-term loan to your given account in case they notice that you are facing trouble while overdrawing your account. Additionally, the basic features of this app are free, but if you need high-level features, you need to upgrade it, which costs $9.99 each month.

How to Borrow Money from Brigit?

- Upload Brigit app;

- Create an account;

- Add your checking account to the app. Brigit will try to determine how much you earn and spend money. For example, you need to be a client for at least 60 days to have the possibility to borrow and your bank account balance must be > $0.

How Much You Can Get from Brigit?

Usually, the amount is $50-$70. But the amount can reach $250.

Brigit Fees / Charges

Brigit has 2 plans: Basic and Plus. Basic is free, it helps to count and plan your expenses. Plus plan costs $9.99/monthly and will help you to borrow instant cash.

4. FlexWage

Like all the other apps, FlexWage helps the employees to access their wages before they get transferred. This helps them to fulfill their expenses without any problem.

This app also offers you reloadable payroll debit cards for workers who mostly get paper checks. This feature makes it perfect for people who can’t accept direct deposits. But you need to pay some fees, including an on-demand wage transfer fee of $5.

How to Borrow Money from FlexWage?

- Upload the app or create an account through the website;

- Connect your employer and bank account to the App;

- To borrow the money you need to get a FlexWage Debit Card.

How Much You Can Get from FlexWage?

It depends on your payroll data.

5. MoneyLion

More than just a cash advance app, MoneyLion offers banking services too. You can open a no-fee checking account, apply for loans and even manage investments.

One catch with this app is you’ll need to have a checking account and have received two direct deposits into the account before you’ll be eligible for a cash advance. These can include paychecks or even government deposits. The cost for the account is $19.99.

How to Borrow Money from MoneyLion?

- Get the MoneyLion app

- Create an account

- Select Instacash option

How Much Can You Get from MoneyLion?

You’ll be able to get at least $25 and possibly up to $250. If you open a credit builder plus account, you’ll be eligible to get $300.

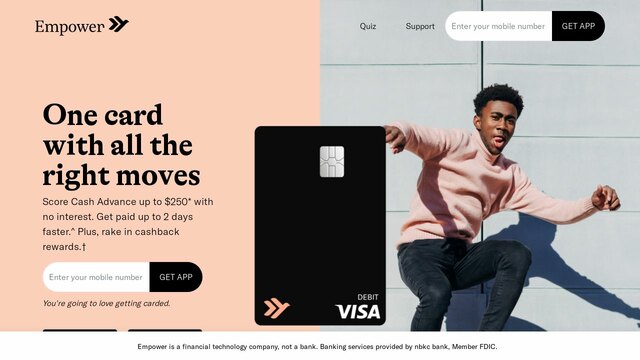

6. Empower

Users will need to sign up for an Empower Card and have their paychecks deposited to their Empower account to be eligible for a payday advance. However, they do offer a no late fee or interest payment policy and don’t do credit checks for those who want to get a cash advance.

The app has a number of other features including a savings feature that automatically transfers money into your savings account. It also helps with budgeting by recommending how much you should devote to specific categories, all based on your income.

You can try Empower free for 14 days. After that, it costs $8 per month.

How to Borrow Money from Empower?

- Get the app.

- Sign up for the Empower Card.

- Have your paycheck directly deposited into your account to create a financial history.

- Apply for a cash advance by following the app’s instructions.

How Much Can You Get from Empower?

Up to $250.

7. Branch

The branch offers interest-free cash advances on your paycheck. However, it could take up to three days for the money to show up in your bank account. You can make a request to another bank, but there will be a fee ranging from $2.99 to $4.99.

How to Borrow Money from Branch?

- Open a checking account.

- Arrange direct deposits into your account.

- Get the app.

- Wait until two months worth of direct deposits into your account.

- Make a cash advance request through the Instant Pay feature.

How Much Can You Get from Branch?

The amount varies and is determined by your direct deposit history, how much you spend, and how much you earn. You can withdraw up to 50% of your paycheck.

Tips for Using Pay Advance Apps Wisely

To make the most out of the cash advance you’re given, here are some things you should know before you download the app.

- Understand the fine details of the loan. Cash advance apps are not all the same. Some require you to pay a monthly membership. Some have fixed fees. Others encourage donations. Be sure you understand what you are getting into before you accept the loan.

- Know the lender. Before you decide to download a cash advance app, do a little research about the company first. You can go to the BBB website or ConsumerFinance.gov to see what reports they have about the company. It’s also vital to read customer reviews of the app and its service. Knowing how other customers rank the service helps you know whether you are dealing with a reliable lender or not.

- Check security features. You’ll need to share some personal information to access the cash, such as your banking details. To protect yourself, check into the company’s data sharing and privacy policies to see if you are comfortable with them. It’s also important to see if the company website is secure or not.

- Update your budget. Getting a payday cash advance means that your next paycheck will be less than usual. You’ll need to adjust your budget accordingly, so you are not short of money in the coming weeks.

- Keep documents. This includes any payments that you make on the loan. Sometimes errors happen, and you may get a call about collections for the loan many months or even years down the road. To protect yourself, be sure that you keep all the records that show you paid it back.