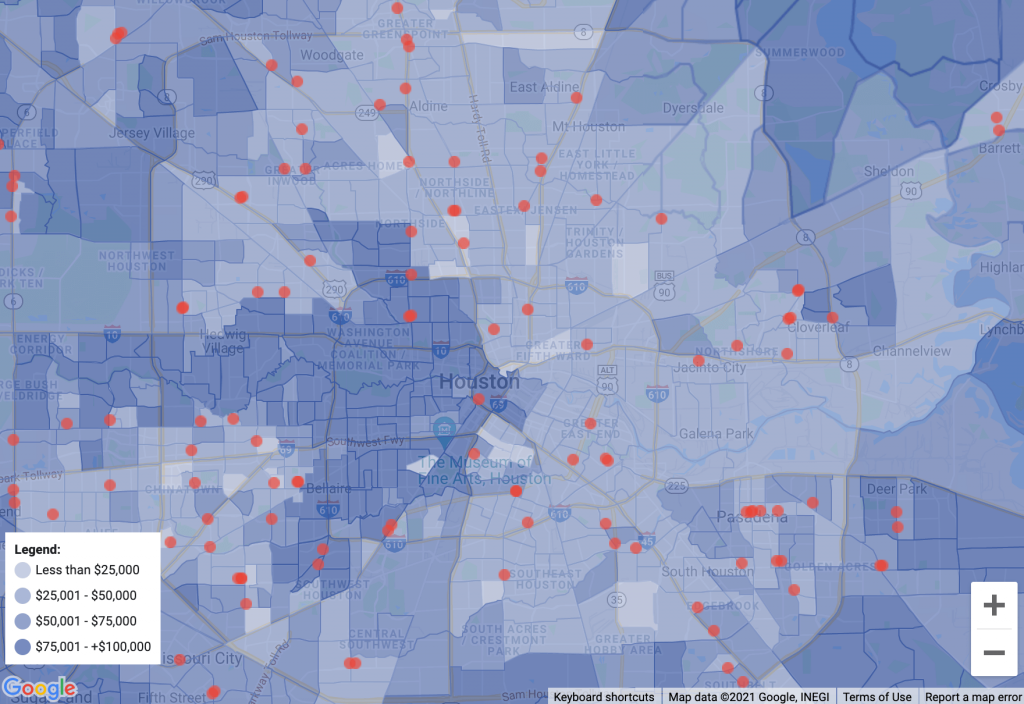

Household Income and Payday Loan Stores Distribution Map

For a visual representation of how payday loan lenders target poor communities, we created an interactive map. Here, we displayed the location of 4,500+ stores from 40 payday lender companies, and also took data from Census.gov (Household Income datasets for 2019-2020 years).

The map is designed to verify early claims (Loyola Consumer Law Review, Poor Zip Codes and Lenders) that store locations depend on household income in the area. That is, the less people earn, the more stores are located near where they live.

The Example: The map undertook a study of Houston city. In the map, the difference between the districts by family income is represented by a division across four income classes.

The range of income applied in the map study are:

- Less than $25,000

- $25,001 – $50,000

- $50,001 – $75,000

- $75,001 – $100,000+

Houston

This example clearly shows the dependence of the payday industry on sectors where household incomes are below <$ 25,000 or are in the range of $ 25,001- $ 50,000, because it is here that the frequency of stores is much higher.

Thus, the result of the data analysis is that there is a direct relationship between the location of the number of stores and areas with low-income families.

Payday Loan Companies in Poor Areas

Payday loans have proven problematic for many debtors over the years. However, more recent concerns have arisen about vulnerable populations being the major target for these payday loan organizations. In this article, we explore the reasons for the concentration of payday loans in poor communities and the potential implication for household income.

Many social commentaries and surveys reveal that payday loan lenders target people earning small amounts to deliver these high-interest loans to them. This is evidenced by the concentration of payday loan lender stores in areas where the residents earn little. Studies have revealed that a large number of micro-credit companies delivering payday loans dwell in poor areas.

The activities of these loan lenders are questionable because payday loans have a high tendency to push persons with low income into perpetual debt. While the loans are helpful in emergencies, the high-interest rates could leave borrowers borrowing and repaying debts for a lifetime.

People that earn little are the most vulnerable in society because they have very low or bad credit scores and many times, they cannot get a credit card. When a person in this risky position takes up a payday loan with its high-interest rate, research has shown that they usually end up borrowing to offset the initial loan and when paying back that loan, the borrowing cycle continues. The loans have to be rolled over because when a person takes a loan for an emergency and has to pay back with ridiculously high rates, they would be unable to pay it back entirely on payday, because what is left if there is any, would not be sufficient to cover their basic expenses.

According to the Consumer Financial Protection Bureau, annualized rates at payday lenders reach about 390 percent and more than 80% of payday loans are rolled over by the borrowers because they can’t pay it back at the time the loan is due. When you compare these interest rates of payday loans with the interest rate of 16% on the average credit card, it makes you see how unnecessary these exorbitant rates really are.

Payday loans are marketed as easy loans because they are given without much requirement. However, research has shown that the interest rates of these payday lenders are more likely to lead the borrower into perpetual debt. When a borrower cannot pay back the debt immediately, they would take another loan to pay it back and the same would happen as each new loan expiry date comes around. This seems to be why these loan lenders target communities where individuals earn little. While this may be profitable for the payday lenders, it leads poor communities into dangerous debts that they keep paying for most of their lives.

Final Thoughts

Clearly, payday lenders are interested in the lower income areas of society. However, since those who earn less are more vulnerable to these risky loans, as a society we should provide more protection for this sector of society. One proposed way is by imposing more regulations on payday lending companies.