6 Ways to Get a Loan With No Credit

Table of Contents

- Join a Credit Union

- Apply for a Credit Builder Loan

- Get a Payday Loan

- Get a Co-Signer

- Explore P2P Lending

- Apply for a Payday Alternative Loan

45 million people in the US have limited or no credit history, including 40% of people aged 20-24. It can be tough to get a loan in this situation – but not impossible.

Read our in-depth guide to learn your options.

How Does One End Up Without a Credit Score?

There are three key reasons why you might not have a credit score:

- You’ve never had any credit accounts, such as credit cards, loans, or mortgages. This is particularly common among young people.

- You have a credit history, but it’s too recent. One’s credit account needs to be at least 6 months old to calculate a score.

- Your credit history is too old. If your credit accounts remain inactive for 6 months or more, they can’t be used for scoring. So if you had credit cards or loans ten years ago, they don’t count anymore.

Can you get a loan without a credit score?

Of course.

In fact, there are many avenues open to you – some with better rates than others.

Read on to discover your 6 key options.

1) Join a Credit Union

Credit unions are nonprofit organizations owned by their members. They offer lower rates and a more personal approach than banks. Usually, you have to become a member before you can apply for a loan.

If you have no credit score, credit unions should be high on your list. They are an excellent low-cost alternative to online lenders and banks. At a union, it’s a human loan officer that makes the decision, not a computer. They don’t just look at your credit score but rather at your financial standing as a whole.

You can always talk to a union employee and explain why you have no credit score – and they will listen. You can even write them a letter.

Each credit union has its eligibility criteria. It can be territorial, serving only people who live or work in a certain area. Or it can be reserved for those in a particular profession or faith. Industries and auto dealerships often have credit unions. There is even a neo-pagan credit union in the works.

To become a member, you’ll need to fill in an application and make a downpayment (usually no more than $25). Keep in mind that you can be eligible for many different unions, so shop around first.

Lenders and rates. You can use this search tool to find a credit union near you. Before you apply for membership, call them and ask if you can get a loan with no score. The union might offer you to get a co-signed or a secured loan. For federal-chartered unions, the maximum APR is 18%, with an average of 9.3%. For state-chartered unions, the average is 11.3%.

2) Apply for a Credit Builder Loan

Credit builder loans are specifically designed to help you build up your credit score. Keep in mind that it’s not a way to get money quickly in case of an emergency. In fact, you won’t see the money for at least 6 months!

Here’s how credit builder loans work. When the lender approves your application, the amount is transferred into a bank account controlled by the lender. That’s right – you can’t touch that money. But you still need to make your monthly payments.

Once you pay off the loan completely, you’ll finally get the money. In return, the lender reports your payments to several leading credit bureaus. Normally it’s Equifax, Experian and TransUnion. This way, your credit score keeps improving – as long as you pay on time, that is.

When you have no credit history, a single late payment can seriously damage your score. So you should be extra-careful when paying off your credit builder loan, otherwise, you can end up worse than before.

Why do lenders offer such loans?

Because they want you to become their customer and get a bigger loan in the future. And for that, you’ll need a higher score. It’s a win-win scheme.

Lenders and rates. Usually, credit builder loans don’t exceed $1000, and the term is between 6 months and 2 years. The APR is often lower than 10%, though it can reach 16%.

Big banks don’t offer credit builder loans. But you can get one from a small community bank. Another option is credit unions. Among online lenders, you can try Self Inc. or Fig Loans.

Finally, one more avenue to explore is Community Development Financial Institutions (CDFIs). They are a type of credit union focusing on people with low income who don’t qualify for traditional banking services. You can look for a CDFI near you on this site. Expect an APR of about 12%.

3) Get a Payday Loan

Payday loans are small (up to $1500), short-term loans usually used for emergencies. You are expected to repay within two weeks to one month when your next paycheck arrives.

Payday loans are the fastest way to get cash when you really need it. Health emergency, urgent car repairs, or an unexpected trip – in these situations, you can’t wait a week or two to get a loan from a credit union or a P2P platform.

To get a payday loan, you need to be employed and have a bank account. Usually, there’s a minimum income requirement (circa $500). Companies providing payday loans don’t require that you have a credit score. They will look at it if you provide it, though.

Payday lenders don’t perform hard credit checks – that is, they don’t request information from credit bureaus. But they do have soft checks of their own. Such a check won’t damage your score if you have it. However, if you don’t pass the check, the company can still refuse you a loan. It’s not common, though: most providers have a 97%-98% approval rate.

It’s very important to repay your payday loan on time – as soon as you receive your next paycheck. Late payments can result in very high fees. These are emergency loans, after all.

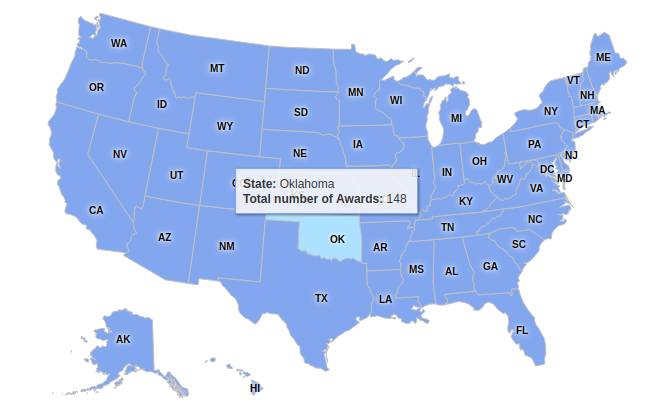

Lenders and rates. On average, you’ll have to pay $15 for each $100 you borrow – that’s an APR of 400%. However, some states impose restrictions on providers. For example, in Ohio, the maximum APR is 28%. Some states banned payday lending altogether. You can find a lender near you using this UstatesLoans.org.

4) Get a Co-Signer

A co-signer is someone who shares the responsibility for paying off the loan with you. Essentially they act as a guarantor. If you are late on your payments, it will be up to the co-signer to pay.

It’s important to understand the difference between a joint loan and a co-signed loan. In joint loans, both co-borrowers have access to money. Your co-borrower will also have access to full information about the loan: when you paid, how much, etc.

In co-signed loans, only you will be able to use the money. The co-signer is there only as an additional guarantee for the lender.

Anyone can be your co-signer: spouse, family member, friend, etc. The important thing is that they should have a good or excellent credit score. The lender will examine both your credit histories. So even if you have no credit but your co-signer has a high score (say, 700), you’ll be able to get a loan at a reasonable rate.

For your co-signer, such a loan is a risk, of course. If you can’t pay off, they’ll have to do it with their own money. Moreover, their own credit score will suffer. So make sure to have an honest discussion when you ask someone to co-sign.

On the other hand, if you pay off on time, both your credit histories will improve. You’ll be able to build up your score, and the co-signer will further increase theirs.

Lenders and rates. Among major banks, PNC and Wells Fargo allow co-signers – and even require them for undergraduate student loans. You can also get a co-signed loan from OneMain Financial, Upgrade, FreedomPlus, or LendingClub. APR can be as low as 6% for a loan of $1000 and reach 36% for a loan of $50,000. Your co-signer’s credit score can make a huge difference here.

Co-signer release. After a while, you might want to remove your co-signer from the loan. For this, your credit score must improve enough that the lender won’t require that additional guarantee anymore. Not all lenders allow this, however. So double-check before you sign up for the loan if co-signer release is possible with your lender.

5) Explore P2P Lending

P2P, or peer-to-peer lending, means that you borrow from another individual, not a financial institution. Borrowers and lenders are brought together by special platforms that charge a commission.

The boom of P2P lending started after the 2008 financial crisis when it became very hard to get a loan from a bank. Nowadays it’s a $230 billion industry that grows by 25% every year.

Anyone can post a loan request on a P2P platform, and it will be visible to all lenders, even though they won’t know your name. Individual lenders look beyond your credit score and consider your financial situation as a whole – where you work or study, your income sources, and so on.

If you have no credit score, you’ll need to write a really good application to convince lenders that you can pay off. Explain very clearly how you’ll use the money. Include all the documents you can gather: pay stubs, tax forms, proof that you get disability benefits, etc. Think of it as applying for a job.

There are thousands of lenders on each platform. So there’s always a chance that you’ll find someone willing to work with you. And if it doesn’t work out on one platform, you can try others – applying for a loan is free.

Lenders and rates. The largest P2P platform is Lending Club, which has already issued almost $57bn in loans. Other good platforms for users with no credit score are Upstart and Peerform. You can also try Prosper or SoFi. Most loans are below $35,000. APR ranges from 5% to 35%. On average, rates are a bit lower on SoFi and Upstart.

When comparing platforms, take into account the origination fee: it can reach 5% of the loan.

6) Apply for a Payday Alternative Loan

In 2010, the National Credit Union Administration launched a new program called PAL (Payday Alternative Loans). This is an interesting mix between payday lending and traditional credit union loans.

PALs come in two types:

- PAL I: up to $1000 for 1 to 6 months with an APR of up to 28%. You need to be a member of the credit union for at least one month before you can apply for PAL I.

- PAL II: up to $2000 for a period of 1-12 months, you can apply as soon as you join the union.

PALs have lower rates than payday loans, but they are more difficult to apply for. Another difference is that the credit union will report your payments to the credit bureaus. So if you pay off on time, your score will improve.

Lenders and rates. Less than 15% of federal credit unions offer PALs. You’ll need to call several unions and ask (use this tool to locate them). Without a credit score, you’ll probably get an APR close to a maximum of 28%. The application fee is about $20.

State-chartered unions offer products similar to PALs, though they are not regulated in the same way. Their rates are lower – 18% on average. But if you apply for such a ‘PAL’, double-check the application fee: it can be quite high.

Summary: What to Choose

People with no credit score have more options than they think when it comes to loans. There is no single best option, though.

Your choice should depend on your objective and circumstances:

- No urgent need for cash – you just want to build your score: credit builder loan

- Medium-urgent, small amount: PAL

- Medium-urgent, larger amount: credit union (possibly with a co-signer) or P2P

- Emergency – you need cash right now but can pay off quickly: payday loan

With all types of loans, make sure to shop around. Compare not just APR rates but also origination and application fees. But most importantly, think of how you can prove your financial standing. Without a credit score, every document and every proof of income can have a huge impact on the interest rate.